By Procopio Of Counsel David C. Boatwright, Partner Pedro E. Corona de la Fuente, Partner Eric D. Swenson, and Associate L. Reza Wrathall

Given a range of changes made to the Internal Revenue Code by the Tax Cuts and Jobs Act of 2017—which we’ll call the “Tax Act” for short—many privately held businesses are reconsidering their current corporate structure. The new law enacted a number of substantial changes, leading CEOs and in-house counsel to wonder whether it is more advantageous to conduct their businesses as pass-through entities or, alternatively, as C corporations.

Is it best to operate and eventually sell a business within a C corporation or within a pass-through entity such as an S corporation, or as an LLC characterized for income tax purposes as a disregarded entity or as a partnership? Let’s consider some changes to the tax code and what those changes may mean to your company and its future.

Among many other things, the Tax Act:

In addition, the Tax Act provides for a new 20% deduction for so-called “qualified business income” (“QBI”) derived through the conduct of an active business by pass-through entities and sole proprietorships that could, where the deduction is applicable without limitation, reduce the maximum effective federal individual income tax rate on such income from 37% to 29.6%. At the same time, for the taxable years 2018 through 2025, the Tax Act limits the deduction for individuals for state and local income taxes (whether or not related to a trade or business) and real property taxes unrelated to a trade or business or investment to a combined $10,000 (without adjustment for inflation), but does not limit such deductions for C corporations.

So what does that actually mean? Well, in some cases, tax treatment as a C corporation may offer a significant advantage over operating as a pass-through entity. As noted above, there are a variety of factors favoring C corporation status, including the new 21% corporate tax rate, relatively higher ordinary income rates for individuals, the availability of an unlimited deduction for state and local corporate income and property taxes, the potential for deferral of federal income taxation at the individual shareholder level, and, as explained further below, the potential exclusion of gain from the sale of qualifying small business stock (“QSBS”).

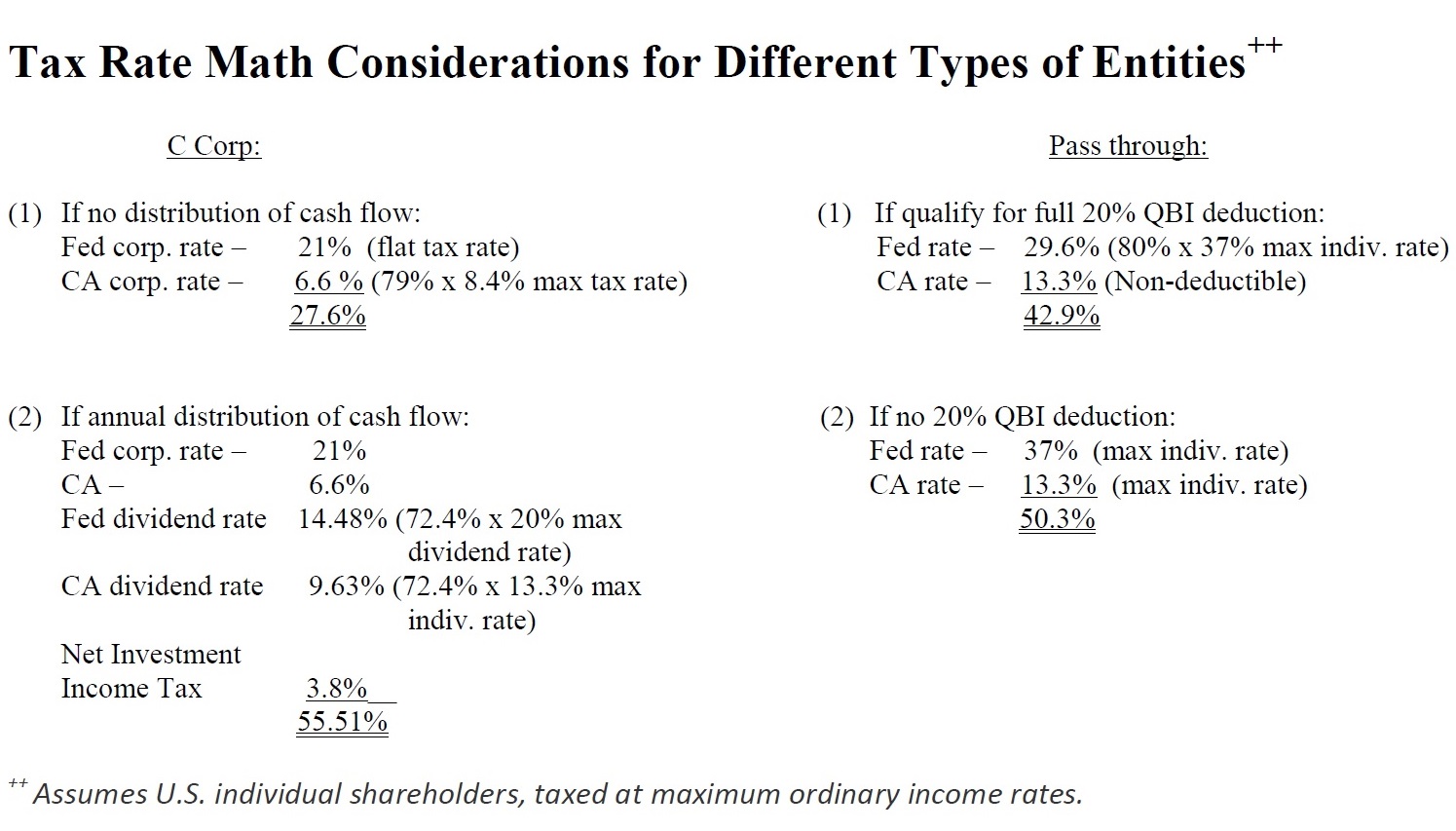

Taken as a whole, these factors sometimes (but not often in our view) weigh in favor of operating as a C corporation, particularly where a business is growing and its earnings are being reinvested in the business and reinvestment is anticipated to occur through the planned exit (sale) or liquidity (IPO) event. We show this in the “Tax Rate Math Considerations” insert below. Note there is a favorable 27.6% combined (federal and CA state) tax rate for a C corporation that is accumulating cash to grow, versus a 42.9% combined tax rate for a pass through that qualifies for the full 20% QBI deduction (assuming ordinary income) or a 50.3% (combined) rate if the company would not qualify for the full QBI deduction. However, if the plan is to distribute excess net cash flow over a considerable period of time before an exit or liquidity event, or where no exit or liquidity event is contemplated because, for example, the plan is to keep the business in the family indefinitely, operating as a pass-through entity will normally make the most sense (and cents!). This is because of the better overall tax rate available to pass-through entities that distribute their earnings and because the basis step-up available to the heirs of the founder(s) that can be taken advantage of by pass-through entities but will be of more limited benefit to estates owning the business through a C corporation.

There are a number of other important things for you to consider regarding your choice of entity selection, including whether to convert an existing pass-through entity to a C corporation:

1. Will Congress increase what is often described as a “permanent” 21% federal tax rate for C corporations? Although we do not have a crystal ball, it’s possible that a political shift in favor of Democratic Party candidates for U.S. House and open Senate seats in the midterm elections of 2018, as well as for the Presidency and U.S. House and open Senate seats in the elections of 2020, could result in at least a partial reversal of new tax provisions that weigh in favor of operating as a C corporation. Because the Presidency will be a Republican one for at least three more years, it is unlikely that any bill out of Congress to increase the 21% corporate rate would survive a presidential veto, but, after three years, an increase to the 21% rate should be considered a realistic possibility when deciding whether to use a C corporation.

2. What is my exit strategy (if there is one)? Consider the following potential tax implications based on the timing of an exit and possible magnitude of the exit:

3. What is my possible “haircut” on exit in the event of a stock sale? If, on exit, a seller insists on a stock sale rather than an asset sale to avoid the double tax that would apply to an asset sale by a C corporation (or an S corporation that is subject to the built-in gains tax)—which would carry the baggage of a possibly lower sales price because the buyer could not amortize an asset basis step-up that would reduce future taxable earnings to pay a portion of the price—how does this haircut compare to (i) any QSBS benefit to the selling shareholders and the total amount thereof, plus (ii) any improved after-tax earnings due to the relatively favorable C corporation rate over the anticipated period before exit (assuming the rate remains at 21%), plus or minus (iii) for a corporation with one or more foreign subsidiaries, the costs or benefits (discussed below)? It is important to note that the benefit of the basis step-up to a corporate buyer in an asset sale is now less valuable due the decrease in the C corporate rate from 35% to 21%, but it remains potentially quite valuable.

4. Would my C corporation be subject to the Accumulated Earnings Tax? The Accumulated Earnings Tax (“AET”) is an anti-deferral regime for undistributed earnings of a C corporation. The AET applies where the failure to make shareholder distributions indicates intentional avoidance of the shareholder level tax. A 20% tax could be potentially assessed on accumulated taxable income in excess of “the reasonable needs of the business.”

5. If there are foreign subsidiaries, could termination of my S corporation status trigger a transition tax liability? The Tax Act imposes a one-time mandatory transition tax on the previously untaxed accumulated foreign earnings of certain foreign subsidiaries at a rate of 15.5% (for cash and cash-equivalent profits) and 8% (on other reinvested foreign earnings). In the case of an S corporation with foreign corporate subsidiaries, each of the S corporation’s shareholders may elect to defer payment of the one time mandatory transition tax indefinitely until the occurrence of certain “triggering events.” Upon the occurrence of a“triggering event,” the S corporation’s shareholders can elect to pay the tax over eight annual installments (without interest). Importantly, the “triggering events” include the termination of S corporation status, the liquidation or sale of substantially all of the assets of the S corporation, the S corporation ceasing to exist, or a transfer of any share of stock in the S corporation by the taxpayer (including upon death). Therefore, this benefit of deferring the transition tax ends if and when the corporation converts to a C corporation.

6. What of the potential applicability of the special deduction for foreign-derived income? The Tax Act includes an incentive for U.S. C corporations to sell goods, license intangibles, and provide services to foreign customers. Under the Tax Act, certain income derived by a C corporation from the sale of goods and services abroad is taxed effectively at only 13.125% (instead of the 21% flat rate). The tax benefits from this concept of foreign-derived intangible income (FDII) will be reduced in taxable years beginning after 2025.

Just as each corporation is unique, so are the potential ramifications of federal tax reform. We work with Procopio’s Corporate and M&A attorneys to provide full-service counsel to our clients. Let us know if you’d like to schedule a consultation to discuss how the Tax Act might impact your business and choice of corporate structure.

Patrick Ross, Senior Manager of Marketing & Communications

EmailP: 619.906.5740

Suzie Jayyusi, Events Planner

EmailP: 619.525.3818