How to Timely File an Election for Payment of Tax in Installments

If you are a U.S. person[1] who owns stock of a foreign corporation, we encourage you to continue reading this alert. Here we explain how your income tax liability for 2017 may be severely affected by a new provision introduced by the Tax Cuts and Jobs Act (the “TCJA”).[2]

On December 22, 2017, President Trump signed the TCJA into law, which represents the most significant tax reform since 1986. Of particular significance are the changes related to the enactment of a new participation exemption regime that effectively exempts from U.S. taxation dividends paid by foreign corporations to their U.S. corporate shareholders.

As a measure to transition into the new participation exemption regime, the TCJA requires U.S. shareholders (including individuals) of certain foreign corporations to pay U.S. federal income tax immediately. The tax is based on the foreign corporation’s undistributed earnings and profits, as if such earnings and profits were actually repatriated by the U.S. shareholder as a dividend distribution (the “Mandatory Deemed Repatriation”). This “transition” tax is calculated at reduced rates, and taxpayers have the ability to defer the payment of the resulting income tax liability in installments payable over eight years. Time is of the essence.

Here we briefly address the rules applicable to the Mandatory Deemed Repatriation regime and highlight the importance of making a timely election to defer payment of the income tax liability.

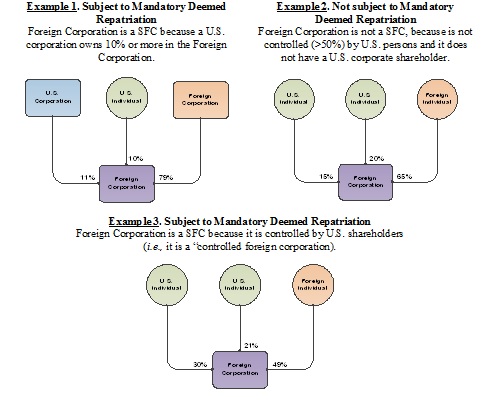

The Mandatory Deemed Repatriation applies to U.S. persons (including individuals) who own 10% or more of the shares of a specified foreign corporation (“SFC”), which include: (i) “controlled foreign corporations”; and (ii) foreign corporations that have a U.S. corporate shareholder that owns 10% or more of the shares in the foreign corporation. U.S. persons who are shareholders of “passive foreign investment companies” are not subject to the Mandatory Deemed Repatriation. Affected U.S. persons are required to include in income their share of the SFC’s undistributed earnings and profits. This rule works “as if” the SFC had repatriated all of its earnings and profits as of December 31, 2017 through a dividend distribution.

See below three examples:

2. Income Inclusion Amount

As noted above, the U.S. shareholders of a SFC are required to include in gross income their pro rata share of the SFC’s accumulated post-1986 earnings and profits. Importantly, the new law does allow U.S. shareholders to reduce amounts included in gross income from one or more SFCs by deficits in earnings and profits from other SFCs in which the U.S. shareholder has an interest. In other words, and in general, netting of earnings and profits among SFCs is allowed.

3. Tax Rates

In broad terms, the new law also imposes two different tax rates on the Mandatory Deemed Repatriation inclusion amount depending on the type of assets held by the SFC. For U.S. corporate shareholders, the rates are: 15.5% for cash and cash equivalents, and 8% for other assets. For U.S. individual shareholders, the rates are: 17.5% for cash and cash equivalents, and 9.05% for other assets.

4. Foreign Tax Credit

U.S. corporate shareholders are entitled to a foreign tax credit, though the new law limits the foreign tax credit to the applicable percentage of any taxes paid by the SFC in its country of residence. U.S. individual shareholders are not entitled to a foreign tax credit (absent a certain election that may be made).

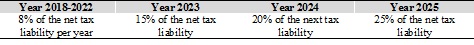

5. Election for Payment in Installments

The new law includes an election taxpayers may make on a timely filed tax return (with regard to extensions) to pay the transition tax over eight years without any additional interest charge. The deferred tax liability is due in 8 installments, with the amount paid each year as follows:

Although the election may be made on an extended tax return, the new law is clear that the first installment payment of the transition tax must be paid by the original due date of the tax return, without regard to extensions. We are of the view, therefore, that the first installment should be paid on the due date for the filing the 2017 return, without regard to extensions, even if the installment election has not been yet filed. Importantly, failure to timely file and pay an installment of the transition tax would result in the remaining installments becoming due on the date of the failure.

Pursuant to IR 2018-53, a taxpayer subject to Mandatory Deemed Repatriation is required to include with the tax return an “IRC 965 Transition Tax Statement,” signed under penalties of perjury, with a calculation of the amount of the transition tax. A model transition tax statement is included in IR 2018-53. A taxpayer makes the installment payment election by including an election statement with the tax return signed under penalties of perjury and containing specified information. A model election statement is included in IR 2018-53.

Regarding payment, IR 2018-53 provides that a taxpayer should make two separate payments as follows: one payment reflecting tax owed without regard to the transition tax, and a second, separate payment for the transition tax. Both payments must be paid by the due date of the applicable return (without extensions). The transition tax payment must be made either by wire transfer or by check or money order. This payment may be the first year’s installment of transition tax if the taxpayer has or will be making the installment payment election or the full amount of the transition tax if the taxpayer is not making the installment payment election.

Based on all of the above, if you own shares of a foreign corporation, we encourage you to contact your international tax advisor for the purpose of analyzing your potential exposure to the new mandatory deemed repatriation regime. Time is of the essence.

Patrick Ross, Senior Manager of Marketing & Communications

EmailP: 619.906.5740

Suzie Jayyusi, Senior Marketing Coordinator Events Planner

EmailP: 619.525.3818

Francisco Sanchez Losada, Marketing and Client Relations Manager

EmailP: 619.515.3225

Sanae Trotter, Senior Manager for Client Relations

EmailP: 650.645.9015